Stubborn Money

Ultimate Guide to the First Home Savings Account Canada

Buying a home is a significant milestone. It's an achievement many Canadians aspire to but find hard to reach due to the increasing cost of properties. Understanding the challenges faced by prospective first-time home buyers, the Canadian government has introduced the First Home Savings Account (FHSA) as a beneficial registered plan. This article will serve as a comprehensive guide to help you understand the benefits, workings, and tax implications of the FHSA. Whether you're a prospective homebuyer or simply interested in Canadian investment avenues, this guide will provide valuable insights.

What is the First Home Savings Account?

In essence, the First Home Savings Account (FHSA) is a tax-free savings account that has been designed to help first-time home buyers save up for their dream home. It's a unique program that offers a host of benefits, making it an attractive savings option for prospective homebuyers. The main eligibility criterion is that the individual has never owned a home before, making it exclusively a first-time buyer benefit. The account has its unique features, like tax advantages, and specific withdrawal rules that will be discussed further in this guide.

How the First Home Savings Account Works

The functionality of the FHSA can be broken down into the following key steps:

1. Opening an Account: The first step towards benefiting from the FHSA is opening an account. This can be done at any Canadian bank or other financial institution. You need to be at least 18 years old and a Canadian resident to be eligible to open this account.

2. Making Contributions: Once the account is set up, the next step is to make savings contributions to your FHSA. The FHSA has both annual and lifetime contribution limits, and it's important to be aware of these to avoid exceeding them, as this could have tax consequences.

3. Account Growth: After the contributions are made, the next stage is the growth of the account. This growth occurs over time and is aided by tax-free benefits and compound interest. In other words, your money grows faster because you're not required to pay taxes on your investment's earnings.

4. Withdrawals: The final step involves making withdrawals from the account when you're ready to buy your first home. These withdrawals from your FHSA for your home purchase are tax-free, which is a significant benefit of the account.

Tax Implications of the First Home Savings Account

One of the main attractions of the First Home Savings Account is its favorable tax implications. These are as follows:

· Deductible Contributions: One of the key advantages of the FHSA is that the contributions you make are tax-deductible. This means that they can be deducted from your income during tax filing, providing immediate income tax benefits.

· Tax-Free Growth: Another major benefit is that the growth of your account is tax-free. This means that the interest, dividends, and capital gains that accumulate within your account do not attract any taxes. This enhances your savings over time.

· Tax-Free Withdrawals: Lastly, when you withdraw funds for the purpose of purchasing your first home, the amount withdrawn is not subject to tax.

However, it's crucial to be aware that non-qualified withdrawals (withdrawals for non-home-buying purposes) or contributions beyond the prescribed limits may have tax consequences. These potential tax penalties underline the importance of understanding the rules of the FHSA before making contributions or withdrawals.

How the First Home Savings Account Compares to Other Saving Options

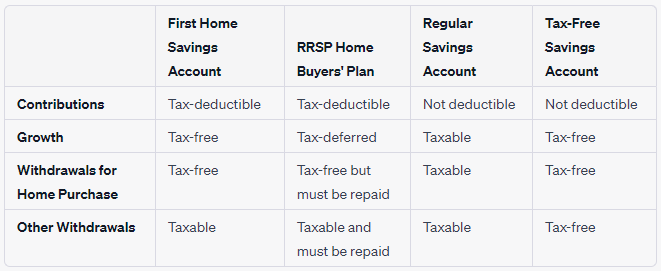

It's helpful to compare the FHSA with other savings options for home buyers in Canada, such as the Registered Retirement Savings Plan's (RRSP) Home Buyers' Plan and saving in a regular savings account or Tax-Free Savings Account (TFSA). Below is a table that outlines the features of these different savings options:

Understanding the above differences can help you make an informed decision about where to save your money for your home purchase.

Strategies to Maximize Your First Home Savings Account

While the FHSA offers several benefits, utilizing some strategies can help you maximize these benefits:

· Optimize Contributions: Try to make the maximum contribution to your FHSA each year to take full advantage of the tax deductions and tax-free growth. However, be careful not to exceed the contribution limits to avoid tax penalties.

· Consider Spousal Accounts: If you're married or have a common-law partner, consider opening an FHSA for your partner as well. This effectively doubles the amount you can save for your home purchase.

· Time Your Withdrawals: Plan your withdrawals strategically to avoid any tax implications. Remember that while withdrawals for home purchases are tax-free, non-qualified withdrawals may be taxable.

· Integrate with Other Plans: Consider how the FHSA fits into your broader financial plan. For instance, you may also be saving for retirement using RRSPs or other savings and pension plans. Balancing these different financial goals is key to achieving overall financial health.

Frequently Asked Questions about the First Home Savings Account

There are some common questions or misconceptions about the FHSA that potential investors often have:

· Can non-residents open an FHSA? No, non-residents cannot open an FHSA. However, changes in residency status can affect an existing FHSA. It's crucial to understand the implications of residency changes on your account to avoid unwanted surprises.

· What happens to the FHSA after a relationship breakdown? The distribution of FHSA amounts in the event of a breakdown of marriage or common-law partnership is subject to specific rules. Understanding these rules can help ensure that you handle such a situation in a way that best preserves your financial interests.

· What happens to the FHSA upon the owner's death? The inheritance of an FHSA and the tax implications that come with it depend on several factors, including whether the deceased had a named beneficiary and the type of income in the account at the time of death.

Conclusion

The FHSA in Canada provides a powerful tool for prospective first-time home buyers. By understanding its benefits, operations, and tax implications, you can leverage this account to make your dream of homeownership a reality. Whether it's the tax deductions on contributions, tax-free growth, or tax-free withdrawals, the FHSA offers a unique set of advantages that can significantly enhance your home-buying savings.

Call to Action

Are you ready to take your first step towards homeownership in Canada? Armed with this guide, you're now equipped to use the FHSA as a strategic tool in your home-buying journey. Don't forget to share this article with other prospective home buyers, leave a comment with your thoughts, or reach out to a financial advisor for personalized advice.

Remember, a house is made of bricks and beams; a home is made of hopes and dreams. Let's make yours a great one! Stay tuned for more detailed insights on the implications of non-residency, relationship breakdowns, and death on your FHSA in our upcoming articles.

Disclaimer: This article is intended for informational purposes only. It's always a good idea to consult with a financial advisor or personal banker before making any significant financial decisions.

Stubborn Money

Welcome to Stubborn Money, where we give you the hard facts for financial success.